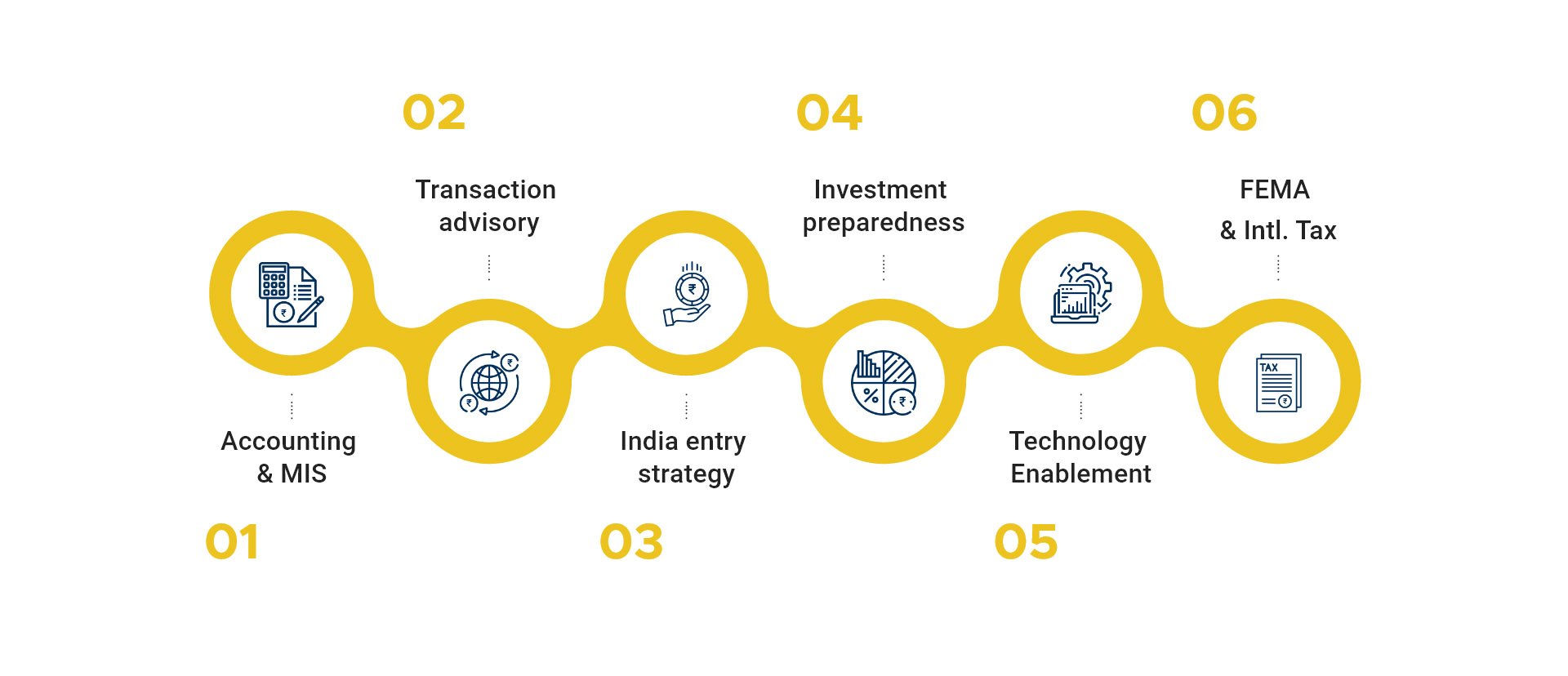

An expert team to support on areas of accounts, MIS, Compliance, funding will be an additional support to the business.

You can definitely take better decision with all the information in hand and an advisor with you to support.

Bringing in the best practices and good technology followed in the industry will help in the business improvement.